Take Charge of Your Credit!

Sign Up for CreditDIY and begin your journey to a better Credit Score now!

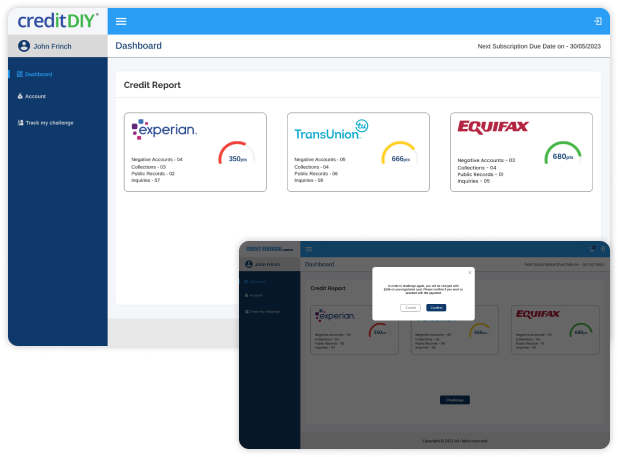

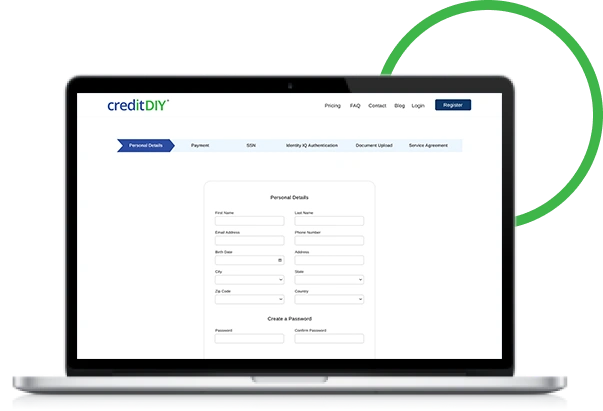

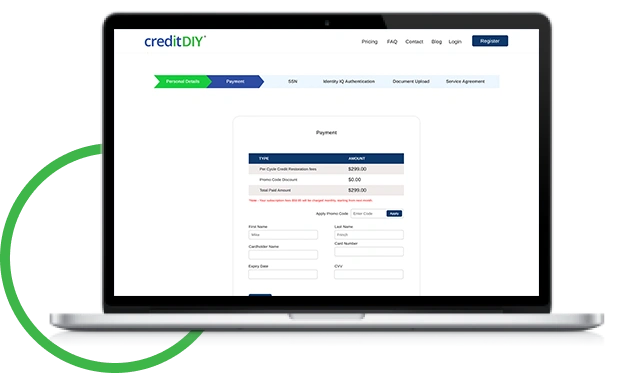

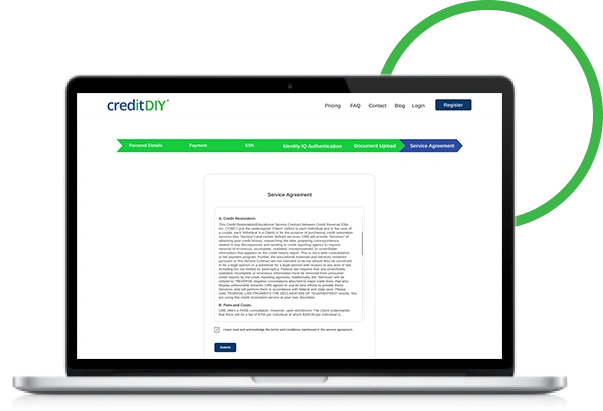

Reverse Your Credit in 6 StepsReclaim Your Financial Health with CreditDIY’s DIY credit repair, designed to help you raise your credit score on your terms. Register at CreditDIY and take control of your finances. Our do it yourself credit repair service is easy to use, quick, and safe. Start your journey to better credit today in just 3 simple steps mentioned below. Step1 Start your DIY Credit Repair experience by visiting www.credit-diy.com. In the upper right corner, click on Register button. Enter your personal and payment information, respond to the security questions, and upload necessary documents, such as your driver’s license or social security card, to confirm your identity and set up your account. Step2 Start your DIY credit repair journey by understanding of your latest credit report, assess your CreditDIY account, and thoroughly review the details of your credit report. CreditDIY reviews your credit report in detail, identifying negative items like late payments, inquiries, charge-offs, etc. Step3 CreditDIY harnesses the power of advanced technologies to repair your credit on your own, instantly crafting dispute letters for any negative entries. CreditDIY efficiently sends these disputes to credit bureaus, simplifying the process and significantly boosting your likelihood of enhancing your credit score. Unlock better loan and credit card approvals by improving your credit score. With CreditDIY, you can dispute negative items and fix report errors that often lead to rejections. Take control and qualify for the financial products you need—without unnecessary denials holding you back. Save thousands in interest over time by boosting your creditworthiness. CreditDIY’s smart prioritization engine tackles the most damaging credit issues first—helping you qualify for lower interest rates and making monthly payments far more manageable. A better credit score doesn’t just affect lending—it can also lower your car and home insurance premiums. Use CreditDIY’s advanced error detection process to clean up inaccuracies and improve how insurers see you. Pay less, simply by fixing what’s broken. Improve your chances of getting approved for rentals without extra deposits or rejections. With CreditDIY’s automated dispute tools and real-time credit syncing, you can present a stronger, more reliable credit profile to landlords—making it easier to find a place to call home. Manage your credit repair easily with CreditDIY’s do it yourself credit repair. We provide you with simple tools and smart DIY credit repair, so you can take charge of your credit repair journey. Unlike traditional companies, we put the power in your hands. Safeguard & repair credit reports yourself with our platform. We keep your personal information safe and confidential. You control your sensitive information. Share it only when you want to. Our platform prioritizes your privacy and security, giving you complete authority over your data. CreditDIY uses automated processes. This means no one can reach your data. With this added security, you lower risks and maintain direct control over your information. We provide the best DIY credit repair & customized strategies to improve your credit score gradually, aligned with your specific financial circumstances. Access clear resources and expert guidance to understand your credit report better. Utilize advanced technology to simplify the process of correcting inaccuracies with our comprehensive support. Our advanced system monitors your credit score in real-time, identifies inaccuracies, and raises disputes on your behalf. Receive real-time support and insights through our platform, guiding you every step of the way. Effortlessly resolve credit report inaccuracies with our automated dispute resolution process, ensuring a quicker path to improving your credit score. A strong credit score opens doors—better loan rates, mortgage approvals, and financial freedom. But bad credit can stall everything. Traditional credit repair services often cost a lot and feel overwhelming. That’s where CreditDIY steps in—with a smarter, low-cost solution built for real people. Our DIY credit repair services hands control back to you. For a one-time sign-up fee and a modest monthly subscription, you get full access to tools that scan your credit report, detect errors, and automatically generate dispute letters based on your unique case. No phone calls. No confusing paperwork. No third-party delays. Just you, your data, and a system built to fix it fast. CreditDIY syncs directly with all three credit bureaus—Experian, TransUnion, and Equifax—so you get real-time alerts and updates as your score improves. Our automatic system prioritizes the most damaging items first, giving you faster results without touching active, positive accounts. More than just fixing credit, CreditDIY helps you understand it. Learn what impacts your score and how to maintain it with built-in guides and a progress tracker dashboard. And because your data stays with you, there’s no need to worry about privacy. Take charge of your credit health confidently and affordably—CreditDIY is your personal tool for lasting financial freedom. Start your journey today..

Users Strong & CountingBoost Your Financial Health With Do It Yourself Credit Repair Software

Start Repairing Your Credit Yourself In 3 Simple Steps

Register Your Account at CreditDIY

Master Your Credit Account

Start Your Credit Building Journey

![]()

![]()

Is Bad Credit Weighing You Down?

Get Approved Faster

Pay Less on Loans

Cut Insurance Costs

Rent Without Rejections

Empower Your Credit Repair Journey with CreditDIY

Transparency & Data Control

Personal Data Autonomy

Selective Data Sharing on Your Terms

Direct Handling Without Intermediaries

Take Charge of Your Credit!

Personalized Credit Building Strategies

Credit Education

Advanced Dispute Navigation

Real-Time Credit Monitoring

Credit Management Made Easy

Smart Assistance

Streamlined Dispute Resolution

CreditDIY: Easy-to-Use Do It Yourself Credit Repair

Sign Up for CreditDIY and begin your journey to a better Credit Score now!

Reverse Your Credit in 6 Steps